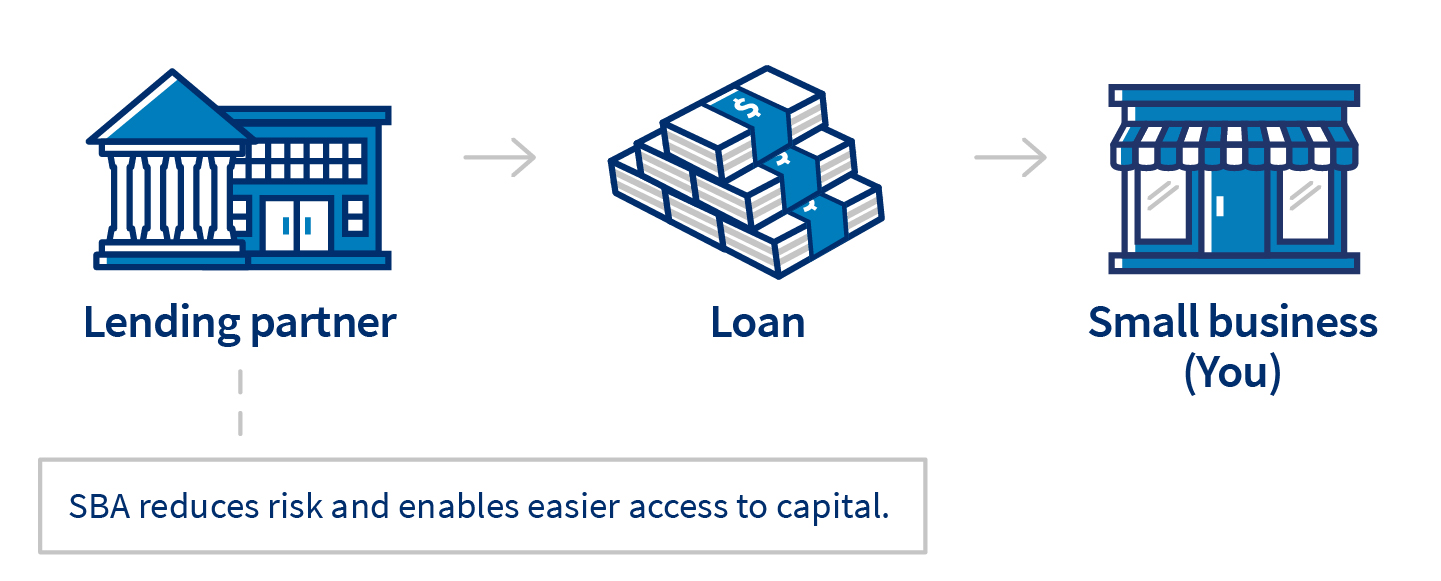

Business Loans – From American Express. The U.S. Small Business Administration helps small businesses get funding by setting guidelines for loans and reducing lender risk. These SBA-backed loans make it easier for small businesses to get the funding they need.

In order to get an SBA-backed loan:

- Visit our Loans page to find the loan that best suits your need

- Enter your Zip Code on Lender Match to find a lender in your area

- Apply for a loan through your local lender

- Lenders will approve and help you manage your loan

SBA only makes direct loans in the case of businesses and homeowners recovering from a declared disaster.

Business Loans – From American Express

SBA partners with lenders to help increase small businesses access to loans.

Benefits of SBA-guaranteed loans

- Competitive terms: SBA-guaranteed loans generally have rates and fees that are comparable to non-guaranteed loans.

- Counseling and education: Some loans come with continued support to help you start and run your business.

- Unique benefits: Lower down payments, flexible overhead requirements, and no collateral needed for some loans.

Stay safe

Protect yourself from predatory lenders by looking for warning signs. Some lenders impose unfair and abusive terms on borrowers through deception and coercion. Watch out for interest rates that are significantly higher than competitors’ rates, or fees that are more than five percent of the loan value. Make sure the lender discloses the annual percentage rate and full payment schedule. A lender should never ask you to lie on paperwork or leave signature boxes blank. Don’t get pressured into taking a loan. Survey competing offers and consider speaking with a financial planner, accountant, or attorney before signing for your next loan.

Get $500 to $5.5 million to fund your business

Loans guaranteed by SBA range from small to large and can be used for most business purposes, including long-term fixed assets and operating capital. Some loan programs set restrictions on how you can use the funds, so check with an SBA-approved lender when requesting a loan. Your lender can match you with the right loan for your business needs.

Working capital

Like seasonal financing, export loans, revolving credit, and refinanced business debt.

Fixed assets

Like furniture, real estate, machinery, equipment, construction, and remodeling.

Eligibility requirements

Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan.

Be a for-profit business

The business is officially registered and operates legally.

Do business in the U.S.

The business is physically located and operates in the United States or its territories.

Have invested equity

The business owner has invested their own time or money into the business.

Exhaust financing options

The business cannot get funds from any other financial lender.

Loans for exporters

Most U.S. banks view loans for exporters as risky. This can make it harder for you to get loans for things like day-to-day operations, advance orders with suppliers, and debt refinancing. That’s why SBA created programs to make it easier for U.S. small businesses to get export loans.

To learn how SBA can help you get an export loan, contact your local SBA International Trade Finance Specialist or SBA’s Office of International Trade.